Veteran and Active Duty Exemptions

The State of Connecticut and Town of Stratford offer various tax exemption programs that are available to Veterans and Active Duty Servicemembers. Our office can assist with figuring out which exemptions you may be entitled to and guide you through the application process.

Applications

Program Name | Due Date - Application Period |

|---|---|

DD-214 Filed on Land Records with Town Clerk | September 30th |

Active Duty Motor Vehicle | December 31st |

Basic Veteran's Exemption | Year-Round |

Additional Veteran’s Exemption | February 1st –October 1st |

Local Option Veteran’s Exemption | February 1st – September 1st |

Disabled Veteran's Exemption | March 31st |

Permanent & Total Service-Connected Disability | March 31 |

Veterans' Exemptions

Basic Veterans' Exemptions

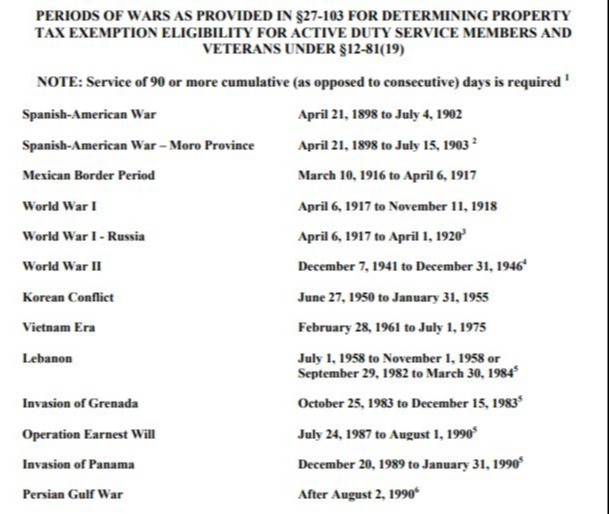

Anyone who has served during one of the state mandated dates of war or military campaigns, or who has a disability rating from the department of veteran’s affairs is eligible for the basic veterans exemption.

Application Process:

You will need to bring a copy of your DD-214 (honorable discharge paperwork) to the Assessor’s Office for review of qualifying war periods. Once the Assessor’s Office has determined your eligibility you will need to file your DD-214 (honorable discharge paperwork) with the Town Clerks Office. Your DD-214 must be on file in the Town Clerks Office no later than September 30th in order to receive the exemption for the October 1st Grand List.

You only have to file your discharge papers once. (Unless you move to another municipality.) We do recommend if you change residence within the Town of Stratford you update your information with the Assessor’s office to ensure that the benefit is applied to the correct property.

Exemption Amount:

The basic veterans exemption is $4,500 off of your assessment. Veterans with disabilities are required to file a copy of their disability letter from the Veterans Administration; the amount of the exemption will vary depending on your disability rating.

You can choose to have your benefit applied to your real estate or your motor vehicle. However we recommend that all real estate owners apply the benefit to the home, as this will ensure they receive the full benefit. Also note, if you own more than one property, State Statute requires that we apply exemptions to your legal domicile.

State Additional Veterans' Exemption

Anyone who is currently receiving the basic veterans exemption may also be eligible for the Local Additional Veterans Exemption. This program is income based.

Income Limits:

Single: $45,200

Married: $55,100

**Please note that your total income is determined by your adjusted gross income plus the total amount of social security you have received.

Application Process:

Applications must be filed with the Assessor’s Office biannually between February 1st and September 30th. Applications will be accepted at the Assessor’s Office.

You will need to bring a copy of your most current tax return along with all related income statements. If you do not file a tax return you will need to bring all your year-end income statements. For further questions please contact the Assessor’s Office at 203-385-4025.

Exemption Amount:

This program will double the exemption amount you are currently receiving through the basic Veteran Exemption program. For example, if you are currently receiving a 4,500 exemption off of your assessment it will be increased to a 9,000 exemption off of your assessment.

Local Additional Veterans Exemption

Anyone who is currently receiving the basic Veteran's Exemption may also be eligible for the Local Additional Veterans Exemption. This program is income based.

Income Limits:

Single: $74,900

Married: $85,000

**Please note that your total income is determined by your adjusted gross income plus the total amount of social security you have received.

Application Process:

Applications must be filed with the Assessor’s Office biannually between February 1st and September 30th.

You will need to bring a copy of your most current tax return along with all related income statements. If you do not file a tax return you will need to bring all your year-end income statements. For further questions please contact the Assessor’s Office at 203-385-4025.

Exemption Amount:

This program is based on a sliding scale according to income and marital status. You can receive an additional 1,000 to 10,000 off of your assessment.

Active-Duty Motor Vehicle Exemption

If you are on active duty as of the October 1 of any given year you are entitled to the tax exemption of ONE motor vehicle. Application must be made annually no later than December 31 of the year the tax becomes due. To download the application for the active-duty serviceman exemption please click here.

Permanent & Total Service-Connected Disability Exemption

Beginning with the Grand List of October 1, 2024, Veteran’s with a Service-Connected Permanent and Total Disability as determined by the U.S. Department of Veteran’s Affairs, are entitled to a 100% exemption of property tax on either (1) a dwelling the Veteran owns and lives in as his or her primary residence, or (2) one motor vehicle he or she owns and keeps in this state.

Click here for the full text of Public Act 24-46

Click here for the Office of Legislative Research Report on PA 24-46 - The Office of Legislative Research is not authorized to provide legal opinions and this report should not be considered one.

STATUTORY DEADLINES - CGS § 12-81(20)

SEPTEMBER 30: DD-214 must be filed on the Stratford Land Records

MARCH 31: Application must be made to the Town of Stratford Tax Assessor’s Office.

Applications will not be considered unless all of the following are included:

1: Completed application signed by qualified Veteran and their spouse, if applicable.

2. Copy of valid photo identification showing proof of residency for qualified Veteran and their spouse, if applicable

3. Most recent copy of your U.S. Department of Veteran’s Affairs Summary of Benefits Letter

4. DD-214 Filed with the Town of Stratford Town Clerk’s Office

Federal Soldiers and Sailors Exemption

If you are an Out-of-State resident who is stationed in Connecticut and have a motor vehicle registered in the State of Connecticut, you may be eligible for the Federal Soldiers and Sailors Exemption Program.

This program provides that personal property belonging to an active duty service member is not subject to local tax because of military orders. The only exception to this rule is business personal property owned by a service member, which can be assessed and taxed by the taxing jurisdiction in which it is located.

Federal Soldier’s and Sailor’s Exemption Application

Application Process:

An application must be filed with the Assessor’s Office annually in order to receive this exemption. The application must be completed by the service member and sworn to before a notary public, or a commissioned officer having attained the grade of ensign or above and returned to the Assessor’s Office. To download an application, please click on the link above.

Exemption Amount:

This program allows for the exemption of any motor vehicle registered in the service members name.